Choosing a portal for your advisory firm is much more difficult than a Google search. Identifying the needs of your organization, impact on workflow and client interaction, and creating efficiencies are the top reasons to take time to select the right RIA portal.

While you want to do your part to help the planet, saving paper shouldn’t be the reason your firm is researching portal options. Sure it will save paper but there are bigger considerations.

Maintain status as the quarterback of the client relationship.

As an advisory firm, you consider yourself the care coordinator for your clients on behalf of other specialists. Therefore it’s important for you to own the information sharing relationship by having accountants, estate planning attorneys, insurance specialists, and other colleagues adding information in your portal versus the other way around. You’re the quarterback. Manage the information sharing hub as your value add to the client relationship.

Eliminate barriers.

Clients want information transferred seamlessly and securely, without headaches or hassles. Dealing with issues caused from trying to share large files blocked by email filters or passwords that are typed incorrectly causes frustration and a less than ideal client service experience. A portal eliminates these (and other) challenges.

Sharing technology to grow referrals.

Most people don’t think of sharing technology when they’re wondering how to generate leads but that’s just what an advisory firm did when closing a complex international deal. To facilitate the process, they shared their technology to all parties involved in the transaction. Everyone said it was the most seamless experience they had, especially given the complexity. As a result, the lender and the escrow agent became referral sources to the advisory firm.

Practical reasons to choose a portal

When used effectively, portals can be an amazing technology tool to assist with client meeting preparation, client conference calls, electronic client meetings, and collaboration with other professionals on behalf of the client.

- Portals can be so easy to use that your advisors will tell you, “That’s it that’s all there is to it?”

- Setting up a portal is fairly easy and straightforward for your team to begin using, even with select clients.

Implementation doesn’t have to be complicated.

Imagine your clients are comfortable with electronic access using your portal within a designated time frame. Integrate into a client outreach strategy by recording a video about how to access the portal and a contact should they have questions. Follow up later to check in.

Implementation could be that simple.

In order to have a simple implementation, you must know the needs of your organization and features of available solutions.

What You Need to Know About the All in One Solution

If your firm’s software application (e.g., CRM, financial planning, portfolio management) comes with a portal, you might wonder if you can continue to use the all-in-one solution. While you can, consider other options as well and here’s why.

An all-in-one solution is a software application that serves a primary function such as financial planning or portfolio management. The ancillary functions include a portal.

While these solutions feel attractive because the portal is included with the price of the all-inclusive package, issues with these all-in-one solutions are multidimensional. Our advisory firms report a variety of challenges with the all in one solutions.

Forced to switch

Should you fall out of love with the primary application such as your CRM or your financial planning software, not only will you need to migrate out of that other application, you also need to migrate the portal. That not only creates two migration scenarios, it adds a sense of urgency during an already stressful time.

Not keeping up with the times

Advisory firms complain the portal doesn’t get as much research and development activity as the core application and isn’t keeping pace with their needs. That’s not surprising given the portal is an ancillary function of the key software product.

This leads to pain points for the advisory firms and clients whose needs aren’t being met.

"You want to integrate…wait, what?”

Many all-in-one portals do not support easy integration with other applications used by financial advisory firms. Case in point, some portals tied to portfolio management software do not make it easy to upload financial planning or other documents to the portfolio management portal, nor do all portals permit clients to upload documents through the portal back to the advisor.

Bottom line, some portals are one-way streets where the advisor can only post documents to the client. Other portals don’t make it automated or easy for you to post other documents besides native documents coming from within the all-in-one application.

What’s an alternative to all-in-one?

Independent portals that are not native to a core application often permit wider integration points and keep pace with technology requested by users. An independent portal makes migration out of a primary software application like CRM or portfolio management less disruptive to workflow.

Tips for Selecting a Portal

If you’re searching for an independent portal, keep the firm and client needs in mind. You want to create efficiencies, not more work.

- Think big picture. Imagine you’re sharing more with clients and want more information from clients than you do today. That’s the portal you want to buy.

- Request a demo. Ask the provider to show you how to get different types of records to the portal in addition to reports.

- Consider non-tech savvy users and their ease of sending files to the correct client even if you have several clients with the same last name.

As you’re considering the possibilities, think about how your firm uses information.

Portals like Citrix® ShareFile have a plug-in for Outlook® for those times when you just need to get information to a third-party with whom you may not have a close relationship. For colleagues and clients it makes more sense to utilize the secure portal for exchanging data.

How easy is the portal to administer? You may need access by several people on multiple folders. An adult child may need to access a parent’s report in addition to the parent, or a trustee needs access to certain reports, those individuals may be able to see more than one folder, or one folder may need to be accessed by more than one relationship.

What if you need a mass deletion or overwrite? Assemblage, which works with many portals, provides the capability to portals who support mass deletion and overwrites.

What controls do clients have? They may need to send files to the advisor and then advisor needs notification of the upload. Do e-mail notifications client come from the firm’s email address or the portal provided email address? You will want to understand this feature when you explain how the portal works with clients so they whitelist email from the portal provider if need be.

Are there compliance considerations? Look for compliance logs in terms of email sent to clients notifying them they have documents to view, as well as who has sent those files.

Who are your primary portal client users? If they are busy career workers or younger clients, chances are they already have experience with something like Dropbox, in which case they may appreciate a feature like a shared folder.

Shared folders enable the advisor to drop a file to their client’s folder, and that file automatically appears in the client’s folder with an email notification to the client who can immediately access from anywhere. They avoid having to log in to access the file.

Bottom line when you are considering a portal, think long-term, consider client needs, review features and continuous development, and the impact of switching portals to your day-to-day operations.

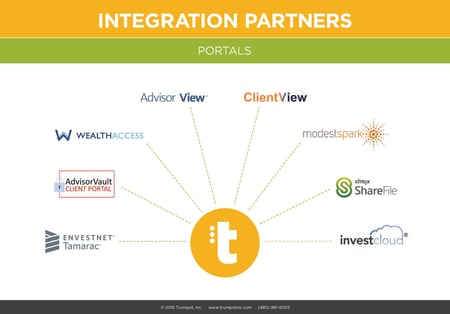

What portals does Assemblage integrate with?

Assemblage report automation software integrates with the most popular portals used by financial advisory firms.

Check out some of our most popular integrations to include portals on the illustration below:

If you don’t see the integration you would like on the list below please contact sales@trumpetinc.com.